A Guide to Understanding and Filing

If you’re facing mounting debt, you may be considering bankruptcy as a way to regain control of your finances. Chapter 13 bankruptcy is one option available to individuals who are struggling to keep up with their debt payments. In this article, we’ll provide an in-depth guide to chapter 13 bankruptcy, including what it is, how it works, and what the benefits and drawbacks are.

1. Introduction

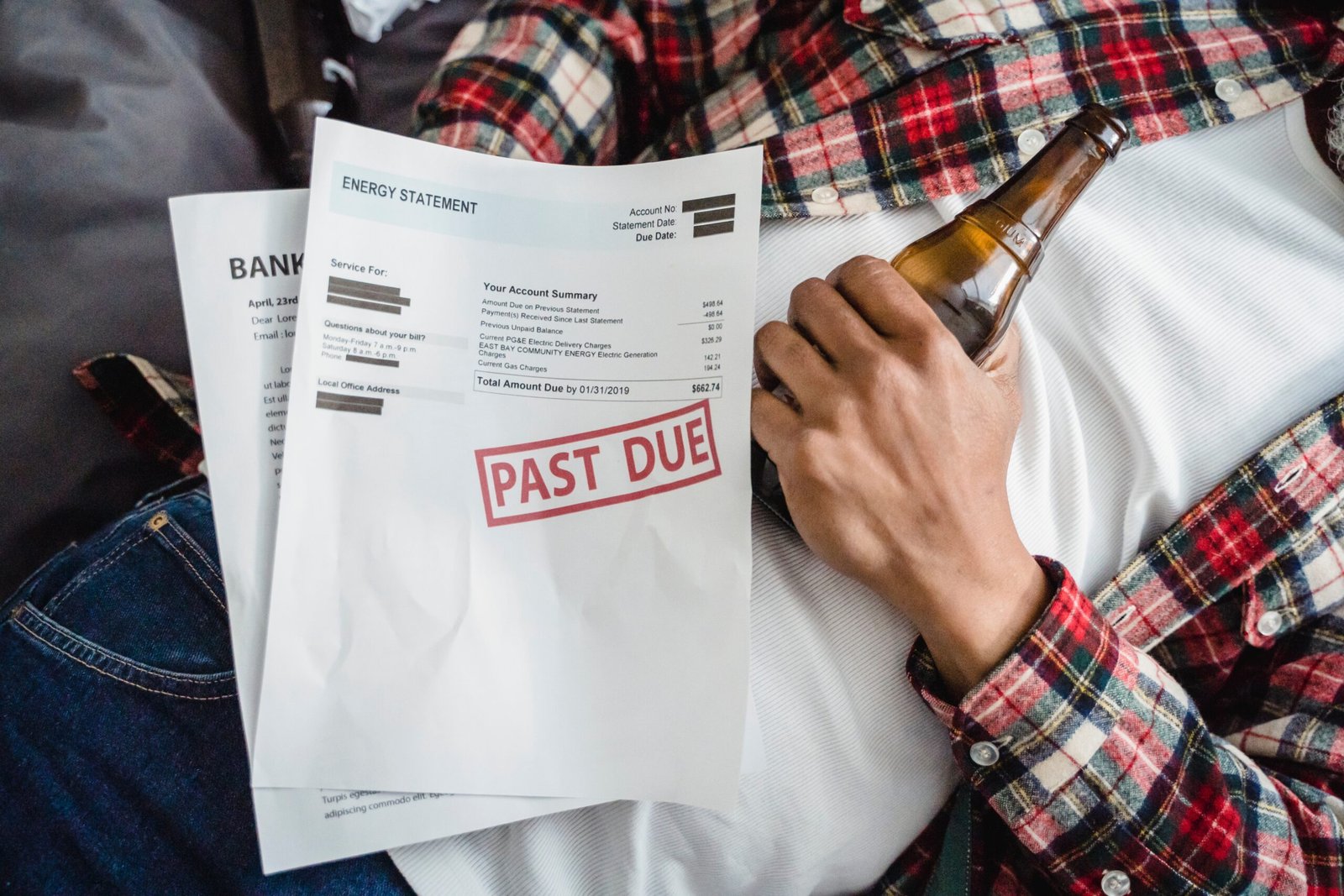

Debt can be a crushing burden that affects every aspect of your life. If you’re struggling to keep up with your payments and feel like you’re drowning in debt, you’re not alone. Many people turn to bankruptcy as a way to regain control of their finances and get a fresh start. Chapter 13 bankruptcy is one option available to individuals who are struggling with debt. In this guide, we’ll take a closer look at what chapter 13 bankruptcy is, who is eligible, how it works, and what the benefits and drawbacks are.

2. What is Chapter 13 Bankruptcy?

Chapter 13 bankruptcy is a type of bankruptcy that allows individuals with regular income to reorganize their debts and develop a repayment plan that is more manageable. Unlike chapter 7 bankruptcy, which involves liquidating assets to pay off debts, chapter 13 bankruptcy allows individuals to keep their assets while paying back a portion of their debts over a period of three to five years.

3. Who is Eligible for Chapter 13 Bankruptcy?

Not everyone is eligible for chapter 13 bankruptcy. To be eligible, you must have a regular income and your unsecured debts (such as credit card debt and medical bills) must be below a certain amount. Additionally, you must not have filed for bankruptcy within the past two years. If you’re not eligible for chapter 13 bankruptcy, you may still be able to file for chapter 7 bankruptcy or explore other debt relief options.

4. How Does Chapter 13 Bankruptcy Work?

Chapter 13 bankruptcy involves developing a repayment plan that allows you to pay off your debts over a period of three to five years. The repayment plan is based on your income and expenses, and it must be approved by the court. During the repayment period, you’ll make monthly payments to a trustee, who will distribute the funds to your creditors. At the end of the repayment period, any remaining debts that are eligible for discharge will be eliminated.

5. Benefits of Chapter 13 Bankruptcy

There are several benefits to filing for chapter 13 bankruptcy. One of the main benefits is that it allows you to keep your assets, such as your home and car. Additionally, chapter 13 bankruptcy can help you get caught up on past-due payments, such as mortgage payments and car payments. It can also provide relief from creditor harassment and wage garnishment.

6. Drawbacks of Chapter 13 Bankruptcy

While chapter 13 bankruptcy can be a helpful tool for managing debt, there are some drawbacks to consider. One of the main drawbacks is that it can take three to five years to complete the repayment plan, which can be a long time to live on a strict budget. Additionally, not all debts are dischargeable in chapter 13 bankruptcy, so you may still be responsible for certain debts, such as student loans and tax debts. Chapter 13 bankruptcy can also negatively impact your credit score and make it more difficult to obtain credit in the future.

7. How to File for Chapter 13 Bankruptcy

Filing for chapter 13 bankruptcy involves several steps, including completing credit counseling, preparing and submitting a petition and repayment plan to the court, attending a meeting of creditors, and completing a debtor education course. It’s important to work with an experienced bankruptcy attorney throughout the process to ensure that your rights are protected and your interests are represented.

8. What Happens After Filing for Chapter 13 Bankruptcy?

After filing for chapter 13 bankruptcy, you’ll begin making monthly payments to your trustee according to your repayment plan. You’ll also need to continue making payments on secured debts, such as your mortgage and car payments. Your trustee will distribute the funds to your creditors, and you’ll receive regular statements that show the progress of your repayment plan. Once you’ve completed the repayment plan, any remaining eligible debts will be discharged.

9. Frequently Asked Questions

- How long does chapter 13 bankruptcy take to complete? Chapter 13 bankruptcy typically takes three to five years to complete.

- Will I lose my home or car if I file for chapter 13 bankruptcy? No, you can typically keep your home and car while filing for chapter 13 bankruptcy.

- What debts can be discharged in chapter 13 bankruptcy? Unsecured debts, such as credit card debt and medical bills, can be discharged in chapter 13 bankruptcy.

- Will chapter 13 bankruptcy stop creditor harassment and wage garnishment? Yes, filing for chapter 13 bankruptcy can provide relief from creditor harassment and wage garnishment.

- How does chapter 13 bankruptcy impact my credit score? Chapter 13 bankruptcy can negatively impact your credit score, but it can also provide an opportunity to start rebuilding your credit.

10. Conclusion

Chapter 13 bankruptcy can be a valuable tool for individuals who are struggling with debt and looking for a way to regain control of their finances. While it may have some drawbacks, it can also provide numerous benefits, including allowing you to keep your assets and providing relief from creditor harassment and wage garnishment. If you’re considering filing for chapter 13 bankruptcy, it’s important to work with an experienced bankruptcy attorney who can guide you through the process and help you achieve a fresh start.

In summary, chapter 13 bankruptcy provides a legal means to manage and reduce debts, with some potential drawbacks. It’s important to consider your eligibility, the repayment plan, and the impact on your credit score before filing. If you have questions or need further guidance, consult with a bankruptcy attorney.