Chapter 7 Bankruptcy: A Comprehensive Guide to Understanding the Process and Its Implications

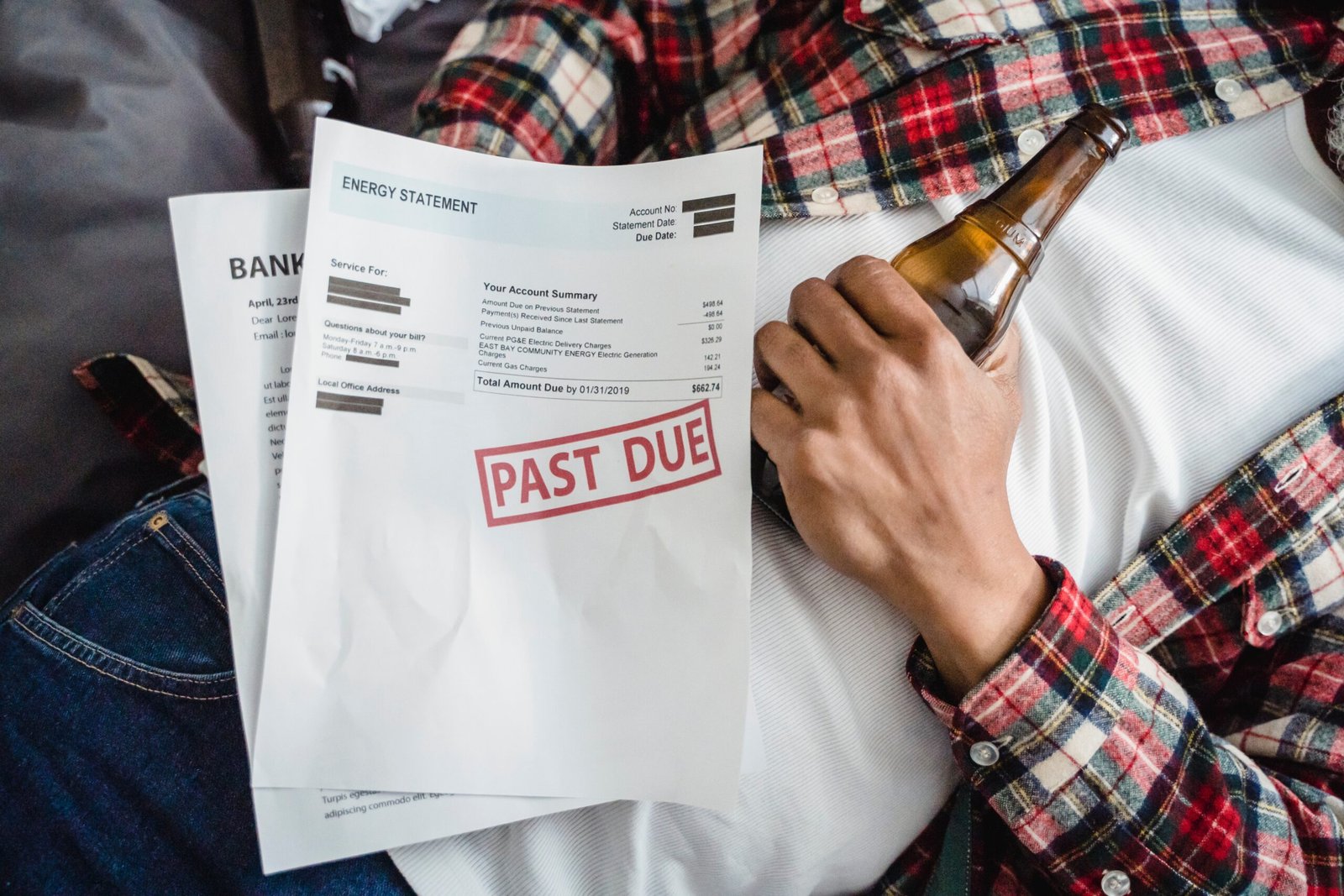

Are you struggling with overwhelming debt and considering filing for bankruptcy? If so, Chapter 7 bankruptcy may be an option worth exploring. This article will provide a comprehensive guide to Chapter 7 bankruptcy, including what it is, who is eligible, how it works, and its implications.

1. What is Chapter 7 bankruptcy?

Chapter 7 bankruptcy, also known as “liquidation bankruptcy,” is a legal process designed to help individuals or businesses with overwhelming debt get a fresh start. In Chapter 7 bankruptcy, a trustee is appointed to gather and sell the debtor’s non-exempt assets to repay creditors. Once the assets are sold and the proceeds are distributed to creditors, the debtor’s remaining eligible debts are discharged, meaning they are no longer responsible for paying them back.

2. Who is eligible for Chapter 7 bankruptcy?

Not everyone is eligible for Chapter 7 bankruptcy. To qualify, you must pass a “means test,” which compares your income to the median income in your state. If your income is below the median income, you are eligible for Chapter 7 bankruptcy. If your income is above the median income, you may still be eligible based on your expenses and other financial circumstances.

3. How does Chapter 7 bankruptcy work?

To file for Chapter 7 bankruptcy, you must first complete credit counseling and gather all of your financial information, including income, expenses, assets, and debts. Once you have this information, you can file a petition with the bankruptcy court in your district. After filing, an automatic stay is issued, which stops all collection activity by your creditors.

A trustee is appointed to review your case and liquidate any non-exempt assets. You will have the opportunity to exempt certain assets, such as your primary residence and personal property, from the liquidation process. Once the trustee has sold your non-exempt assets and distributed the proceeds to your creditors, your remaining eligible debts will be discharged.

4. What are the advantages of Chapter 7 bankruptcy?

One of the biggest advantages of Chapter 7 bankruptcy is that it provides a fresh start by eliminating most of your eligible debts. This can be a huge relief for individuals who are drowning in debt and unable to make their monthly payments. Additionally, the automatic stay provides immediate relief from creditor harassment and collection activity.

5. What are the disadvantages of Chapter 7 bankruptcy?

One of the biggest disadvantages of Chapter 7 bankruptcy is that it may not eliminate all of your debts. Certain debts, such as student loans, taxes, and child support, are generally not dischargeable in bankruptcy. Additionally, the liquidation process may result in the loss of some of your assets, although exemptions may allow you to keep certain property.

6. Can I keep any of my property in Chapter 7 bankruptcy?

Yes, you may be able to keep certain property through exemptions. Each state has its own set of exemptions, which allow you to protect certain assets from liquidation. Some common exemptions include your primary residence, personal property, retirement accounts, and tools of your trade. It’s important to consult with an experienced bankruptcy attorney to determine which exemptions are available to you.

7. Will Chapter 7 bankruptcy eliminate all of my debt?

No, Chapter 7 bankruptcy will not eliminate all of your debt. Certain debts, such as student loans, taxes, and child support, are generally not dischargeable in bankruptcy. Additionally, if you have secured debts, such as a mortgage or car loan, you may be required to continue making payments or risk losing the property.

8. What debts are not dischargeable in Chapter 7 bankruptcy?

Some debts that are not dischargeable in Chapter 7 bankruptcy include:

- Student loans

- Taxes

- Child support and alimony

- Debts incurred through fraud or intentional wrongdoing

- Fines and penalties owed to government agencies

- Debts for personal injury or death caused by driving under the influence

9. How will Chapter 7 bankruptcy impact my credit?

Filing for Chapter 7 bankruptcy will have a negative impact on your credit score and will remain on your credit report for up to 10 years. However, for many individuals, their credit score may already be suffering due to missed payments and high levels of debt. By eliminating your eligible debts, you may actually be able to improve your credit score over time by demonstrating a better debt-to-income ratio and a more stable financial situation.

10. How long does the Chapter 7 bankruptcy process take?

The Chapter 7 bankruptcy process typically takes 3-6 months from the time of filing to the discharge of eligible debts. However, the length of the process can vary depending on the complexity of your case and any challenges that arise during the process.

11. Can I file for Chapter 7 bankruptcy more than once?

Yes, you can file for Chapter 7 bankruptcy more than once, but there are certain restrictions. If you previously received a discharge in a Chapter 7 bankruptcy, you must wait at least 8 years before filing for Chapter 7 again. If you previously filed for Chapter 13 bankruptcy, you may be eligible to file for Chapter 7 after 6 years.

12. What happens after I file for Chapter 7 bankruptcy?

After filing for Chapter 7 bankruptcy, you will attend a meeting of creditors, also known as a 341 meeting. This meeting allows your creditors to ask questions about your financial situation and the bankruptcy process. If there are no objections or challenges to your case, your eligible debts will be discharged and the process will be complete.

13. Will I lose my job if I file for Chapter 7 bankruptcy?

No, filing for Chapter 7 bankruptcy will not result in the loss of your job. However, certain professions, such as those in finance or law enforcement, may have specific requirements regarding bankruptcy filings. It’s important to check with your employer or professional organization to understand any potential implications.

14. How can an attorney help me with Chapter 7 bankruptcy?

An experienced bankruptcy attorney can help guide you through the Chapter 7 bankruptcy process, ensuring that all requirements are met and that you receive the best possible outcome. They can also help you determine which exemptions are available to you and represent you in court if any challenges or objections arise.

15. Is Chapter 7 bankruptcy the right choice for me?

Determining whether Chapter 7 bankruptcy is the right choice for you depends on your individual financial situation and goals.

If you are struggling with overwhelming debt and cannot see a way to repay it, Chapter 7 bankruptcy may be a viable option. However, it’s important to understand the potential consequences and limitations of this process. Consulting with an experienced bankruptcy attorney can help you make an informed decision and navigate the process with confidence.

In conclusion, Chapter 7 bankruptcy is a legal process designed to help individuals and businesses eliminate eligible debts and gain a fresh financial start. While it may have negative consequences on your credit score and financial reputation, it can also offer much-needed relief and a path towards a more stable financial future. By understanding the process and potential outcomes, you can make an informed decision and take control of your financial situation.

16.FAQs

- Is it possible to keep any of my property in Chapter 7 bankruptcy?

Yes, certain exemptions may allow you to keep certain property, such as your primary residence, personal property, retirement accounts, and tools of your trade.

- Will Chapter 7 bankruptcy eliminate all of my debt?

No, certain debts, such as student loans, taxes, and child support, are generally not dischargeable in bankruptcy.

- How will Chapter 7 bankruptcy impact my credit?

Filing for Chapter 7 bankruptcy will have a negative impact on your credit score and will remain on your credit report for up to 10 years.

- Can I file for Chapter 7 bankruptcy more than once?

Yes, but there are certain restrictions depending on whether you previously received a discharge in a Chapter 7 bankruptcy or filed for Chapter 13 bankruptcy.

- How can an attorney help me with Chapter 7 bankruptcy?

An experienced bankruptcy attorney can help guide you through the process, ensure all requirements are met, and represent you in court if any challenges arise.