Introduction

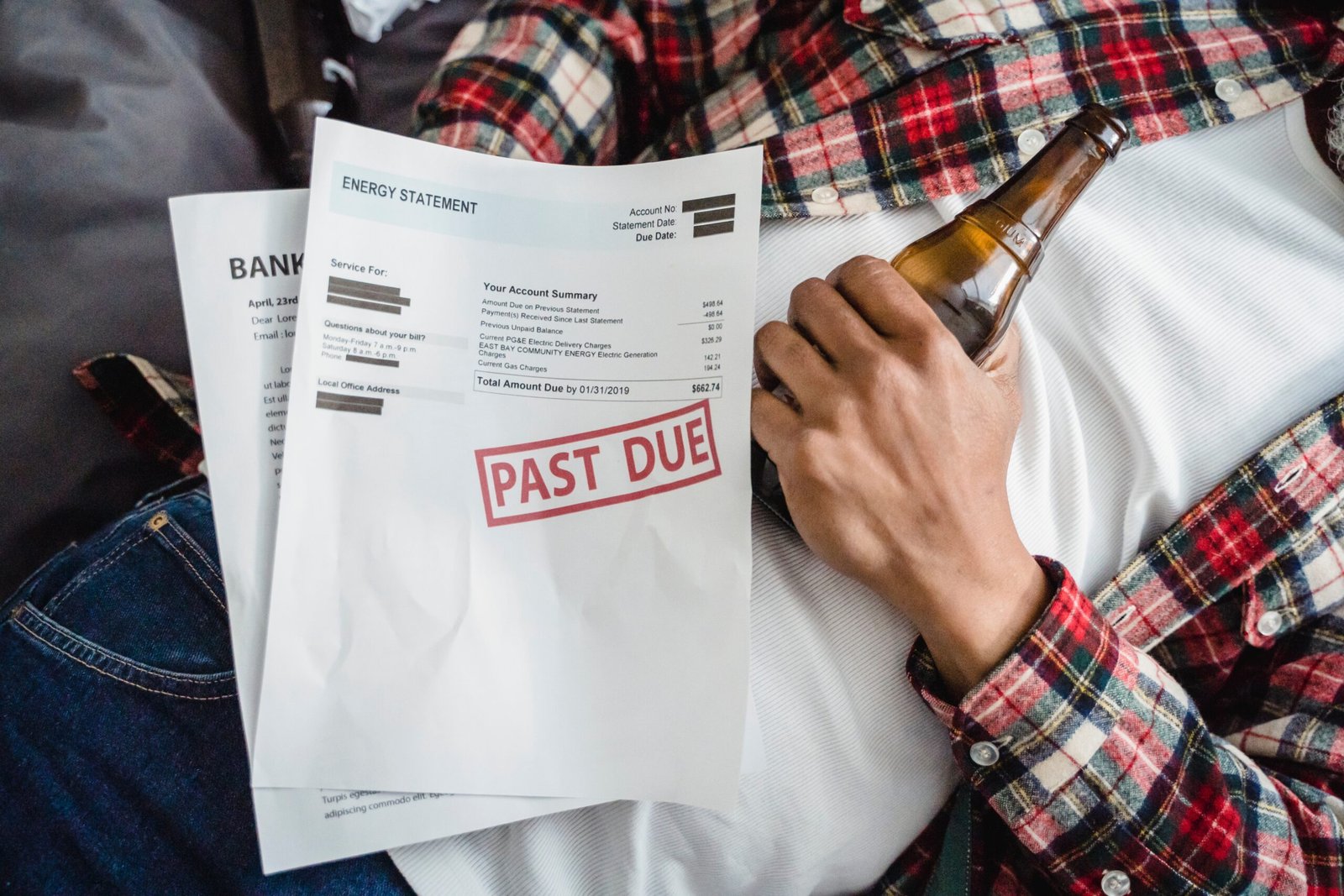

Filing for bankruptcy can be an overwhelming decision. However, it can also be a way to get a fresh financial start. Bankruptcy can help you eliminate or reduce your debts and give you the opportunity to rebuild your credit score. But before you take the plunge, it’s important to understand the different types of bankruptcy, namely Chapter 7 and Chapter 13.

What’s the difference?

Chapter 7 bankruptcy and Chapter 13 bankruptcy are the two most common types of bankruptcy filed in the United States. Here are the key differences between these two types of bankruptcy:

Chapter 7 Bankruptcy

- Also known as “liquidation bankruptcy”

- Assets are sold to pay off debts

- Most unsecured debts are discharged (e.g., credit card debts, medical bills, personal loans)

- Typically lasts around 3-6 months

- Eligibility is determined by a “means test,” which takes into account your income and expenses.

Chapter 13 Bankruptcy

- Also known as “reorganization bankruptcy”

- Debt repayment plan is created based on your income and expenses

- Usually lasts between 3-5 years

- Allows you to keep your assets and catch up on missed payments (e.g., mortgage, car loan)

- Most unsecured debts are discharged after the repayment plan is completed

Which one is right for you?

The decision to file for Chapter 7 or Chapter 13 bankruptcy ultimately depends on your individual financial situation. Here are some factors to consider when making your decision:

- Your income: If your income is below the state median, you may be eligible for Chapter 7 bankruptcy. If your income is above the state median, you may be required to file for Chapter 13 bankruptcy.

- Your assets: If you have significant assets that you want to keep (e.g., a house, car), Chapter 13 may be a better option as it allows you to keep your assets while catching up on missed payments.

- Your debts: If most of your debts are unsecured (e.g., credit card debts, medical bills), Chapter 7 may be a better option as it typically results in the discharge of most unsecured debts.

- Your ability to make payments: If you have a steady income and can afford to make payments, Chapter 13 may be a better option as it allows you to create a debt repayment plan and catch up on missed payments.

Comparison:

| Chapter 7 Bankruptcy | Chapter 13 Bankruptcy | |

|---|---|---|

| Purpose | Liquidation of assets to discharge debts | Reorganization of debts to create a payment plan |

| Eligibility | Based on income and means test | Open to individuals and businesses with regular income |

| Asset Protection | No protection for non-exempt assets | May keep assets while repaying debts |

| Time to Complete | Typically 4-6 months | 3-5 years |

| Credit Score Impact | Can stay on credit report for up to 10 years | Typically stays on credit report for 7 years |

| Cost | Filing fee of $335, plus attorney fees | Filing fee of $310, plus attorney fees |

| Discharge of Debts | Most unsecured debts are discharged | Only some debts are discharged, with remaining debts paid under payment plan |

| Co-signers | Co-signers may still be responsible for debt | Co-signers are protected under payment plan |

| Repayment | No repayment required | Payment plan required |

FAQs:

- Will bankruptcy wipe out all my debts?

No, bankruptcy will not wipe out all your debts. Some debts, such as child support and tax debts, cannot be discharged in bankruptcy.

- Will I lose all my assets in Chapter 7 bankruptcy?

Not necessarily. Certain assets, such as your primary residence and personal property (e.g., clothing, furniture), may be exempt from liquidation.

- Can I switch from Chapter 13 to Chapter 7 bankruptcy?

Yes, it is possible to switch from Chapter 13 to Chapter 7 bankruptcy, but you will need to meet certain eligibility criteria.

Conclusion:

Deciding between Chapter 7 and Chapter 13 bankruptcy can be a complex decision. It’s important to weigh the pros and cons of each option and consider your individual financial situation before making a decision. Consult with a bankruptcy attorney to help you understand your options and determine the best course of action for your unique situation.