Personal Bankruptcy Types and Process

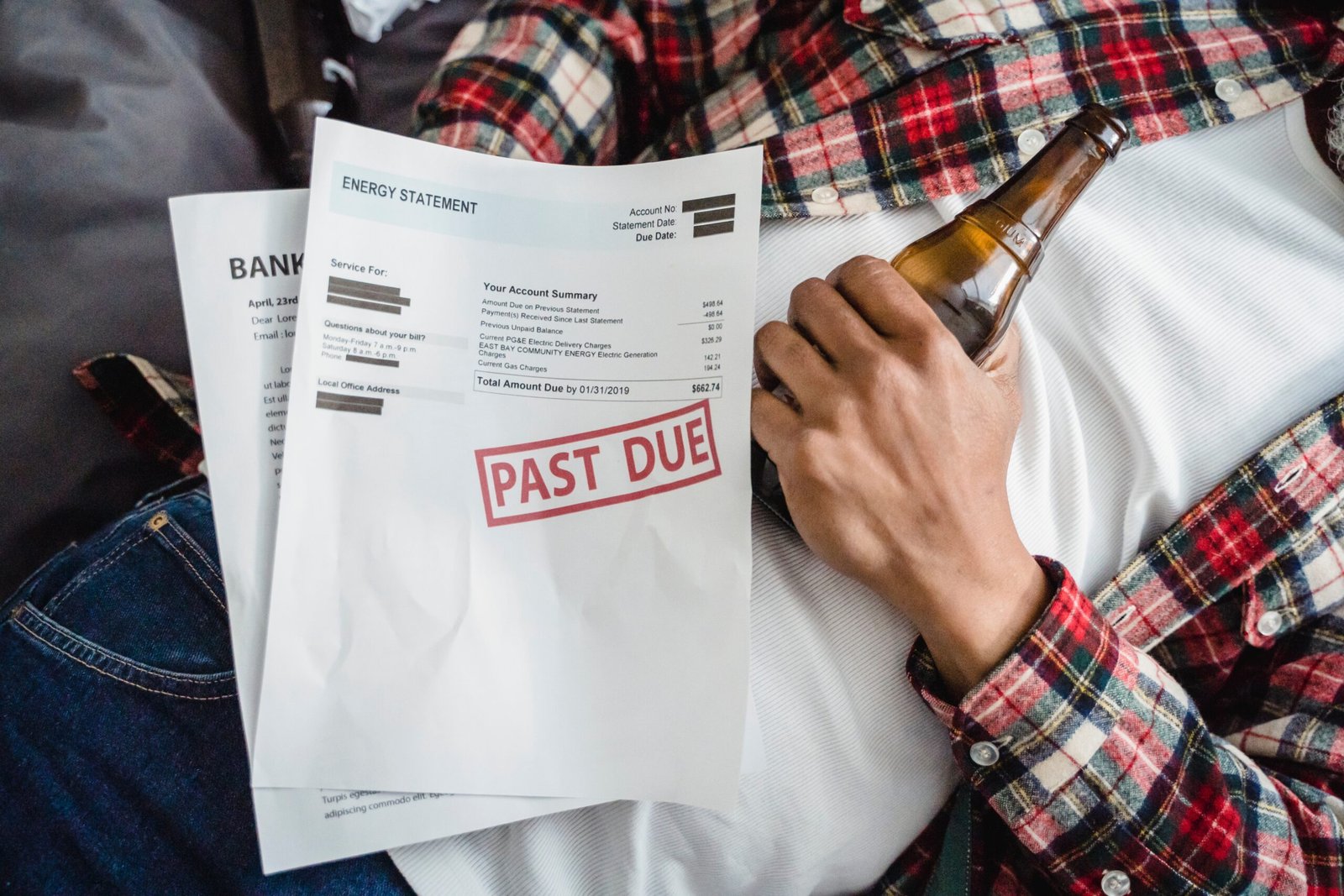

Personal bankruptcy is a legal process in the United States that allows individuals to eliminate or reduce their debt when they are unable to pay it back. The process can be overwhelming, and it is important to understand the types of bankruptcy, the process, and the consequences before deciding to file. In this article, we will discuss the different types of personal bankruptcy in the USA, the process, and what to expect during and after the bankruptcy.

Understanding Personal Bankruptcy

Personal bankruptcy is a legal process that is available to individuals who are unable to pay back their debts. The purpose of bankruptcy is to give individuals a fresh start by eliminating or reducing their debt. Bankruptcy can provide relief from the stress and anxiety of dealing with creditors, collection calls, and lawsuits.

Types of Personal Bankruptcy

There are three types of personal bankruptcy in the USA: Chapter 7, Chapter 13, and Chapter 11. The most common types of personal bankruptcy are Chapter 7 and Chapter 13.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy is also known as a “liquidation bankruptcy.” This type of bankruptcy allows individuals to eliminate most of their unsecured debt, such as credit card debt, medical bills, and personal loans. In a Chapter 7 bankruptcy, the bankruptcy court appoints a trustee who sells the debtor’s non-exempt assets and uses the proceeds to pay off creditors.

Chapter 13 Bankruptcy

Chapter 13 bankruptcy is also known as a “reorganization bankruptcy.” This type of bankruptcy allows individuals to keep their property and assets and pay back their debt over a period of three to five years. In a Chapter 13 bankruptcy, the debtor creates a repayment plan that outlines how they will pay back their debt. The bankruptcy court approves the plan, and the debtor makes monthly payments to a bankruptcy trustee, who then distributes the payments to the creditors.

Chapter 11 Bankruptcy

Chapter 11 bankruptcy is primarily used by businesses but is also available to individuals who have a lot of debt. This type of bankruptcy is similar to Chapter 13 bankruptcy in that it allows the debtor to reorganize their debt and pay it back over a period of time. Chapter 11 bankruptcy is more complex and expensive than Chapter 13 bankruptcy and is usually reserved for individuals with a high income and a lot of debt.

Eligibility for Personal Bankruptcy

To be eligible for personal bankruptcy in the USA, you must meet certain criteria. For Chapter 7 bankruptcy, you must pass the means test, which determines if your income is below the state median income. For Chapter 13 bankruptcy, you must have a regular income and your debt must be within certain limits.

The Process of Personal Bankruptcy

The process of personal bankruptcy can be complex and time-consuming. Here are the steps involved in filing for personal bankruptcy:

Filing for Bankruptcy

To file for bankruptcy, you must fill out the necessary forms and submit them to the bankruptcy

Automatic Stay

Once you file for bankruptcy, an automatic stay goes into effect. This means that creditors are prohibited from taking any action to collect the debt, including garnishing wages, foreclosing on a property, or repossessing a vehicle.

Creditors’ Meeting

Within a few weeks of filing for bankruptcy, you will be required to attend a meeting of creditors. During this meeting, the bankruptcy trustee and your creditors will have the opportunity to ask you questions about your finances and the information you provided in your bankruptcy forms.

Bankruptcy Trustee

The bankruptcy trustee is responsible for overseeing your bankruptcy case. They will review your forms, sell your non-exempt assets in a Chapter 7 bankruptcy, and distribute payments to creditors in a Chapter 13 bankruptcy.

Credit Counseling

Before your bankruptcy case can be discharged, you are required to attend credit counseling. This is a requirement for both Chapter 7 and Chapter 13 bankruptcies and involves meeting with a credit counselor to discuss your finances and create a plan for managing your debt in the future.

Reaffirmation Agreements

If you have secured debt, such as a car loan or a mortgage, you may be required to sign a reaffirmation agreement. This agreement allows you to keep the property in question as long as you continue to make payments on the debt.

Discharge of Debt

The ultimate goal of personal bankruptcy is to discharge your debt. In a Chapter 7 bankruptcy, most of your unsecured debt will be eliminated, while in a Chapter 13 bankruptcy, you will be required to make payments for a period of three to five years before your remaining debt is discharged.

Pros and Cons of Personal Bankruptcy

There are both advantages and disadvantages to filing for personal bankruptcy. Some of the benefits include the elimination of most or all of your unsecured debt, protection from creditors, and the ability to start fresh financially. However, there are also negative consequences, including damage to your credit score, the loss of assets in a Chapter 7 bankruptcy, and the potential for social stigma.

Impact of Personal Bankruptcy

Personal bankruptcy can have a significant impact on your finances, employment, and property. Here are some of the ways that bankruptcy can affect you:

Credit Score

Filing for bankruptcy can have a negative impact on your credit score. However, the exact impact will depend on your individual circumstances. Bankruptcy will remain on your credit report for up to ten years.

Employment

In most cases, filing for bankruptcy will not affect your employment. However, certain jobs, such as those in the financial industry, may be impacted by a bankruptcy filing.

Property and Assets

In a Chapter 7 bankruptcy, you may be required to surrender some of your assets to the bankruptcy trustee. However, in a Chapter 13 bankruptcy, you can usually keep your property and assets as long as you continue to make payments on your debt.

Alternatives to Personal Bankruptcy

Bankruptcy should be considered a last resort when all other options have been exhausted. Some alternatives to bankruptcy include debt consolidation, debt settlement, and credit counseling.

Conclusion

Personal bankruptcy can be a difficult and stressful process, but it can also provide relief from overwhelming debt. If you are considering bankruptcy, it is important to understand the different types of bankruptcy, the eligibility requirements, and the process. It is also important to consider the potential impact of bankruptcy on your credit score, employment, and property. Before making a decision, it is recommended that you speak with a bankruptcy attorney or a credit counselor to explore all of your options.

FAQs

- What is the difference between Chapter 7 and Chapter 13 bankruptcy?

- Will I lose all of my property if I file for bankruptcy?

- Can I file for bankruptcy if I have already filed for bankruptcy in the past?

- How long will bankruptcy stay on my credit report?

- Is it possible to file for bankruptcy without an attorney?

1. What is the difference between Chapter 7 and Chapter 13 bankruptcy?

Chapter 7 bankruptcy is also known as “liquidation” bankruptcy and involves the liquidation of your non-exempt assets to pay off your creditors. In contrast, Chapter 13 bankruptcy is also known as “reorganization” bankruptcy and involves creating a repayment plan to pay off your debts over a period of three to five years.

2. Will I lose all of my property if I file for bankruptcy?

In a Chapter 7 bankruptcy, you may be required to surrender some of your assets to the bankruptcy trustee to be sold to pay off your creditors. However, there are exemptions that protect certain types of property, such as your primary residence and personal belongings. In a Chapter 13 bankruptcy, you can usually keep your property and assets as long as you continue to make payments on your debt.

3. Can I file for bankruptcy if I have already filed for bankruptcy in the past?

You may be eligible to file for bankruptcy again, but there are time limits between filings. If you previously filed for Chapter 7 bankruptcy, you must wait eight years before filing again. If you previously filed for Chapter 13 bankruptcy, you must wait two years before filing again.

4. How long will bankruptcy stay on my credit report?

Bankruptcy will remain on your credit report for up to ten years, depending on the type of bankruptcy you filed.

5. Is it possible to file for bankruptcy without an attorney?

Yes, it is possible to file for bankruptcy without an attorney, but it is not recommended. Bankruptcy is a complex legal process, and an attorney can help ensure that your bankruptcy case is handled properly and that you receive the best possible outcome.